You can use Sage 200 to keep a record of your stock items, including where they are stored, how many you have in stock, how much you paid for them (value), how many you've bought and sold.

How Sage 200 manages your stock items

The stock control functions in Sage 200 are fully integrated with Invoicing, Sales Orders and Purchase Orders. This means that information about your stock item levels and values are updated at each stage of the sales and purchase processes. It is important that you understand how this integration works as this is key to making the most of the functions available in Sage 200.

The Invoicing process

| Sales order | Updates stock |

|---|---|

|

Post invoice |

The stock level is reduced at the specified warehouse. The stock history is updated with a record of the stock being allocated and despatched. If there is not sufficient stock at the time the invoice is posted, the stock level becomes negative, unless the stock item uses the Average costing method. These items can't have a negative stock level, so the invoice can't be posted until the stock levels are updated. |

The sales order process

| Sales order | Updates stock |

|---|---|

|

Enter sales order and allocate stock |

Add items you sell to sales orders for your customers. Free stock is automatically allocated to the order. The free stock quantity is reduced but the stock levels are not updated. This reserves the stock items for this order so the stock can't be allocated to a different subsequent order. However the stock is still in the warehouse, and will be reported on a stocktake or stock valuation report. If there is not sufficient stock at the time the order is entered, the remaining stock can be allocated manually when new stock arrives. |

| Print picking list | Prints a list of the stock items and their location (in warehouse and /or bin). Used by the warehouse staff to select item for despatch |

| Despatch stock |

The stock level is reduced at the specified warehouse. |

The purchase order process

| Purchase order process | Updates stock |

|---|---|

| Enter purchase order | Add items you buy to purchase orders for your suppliers. |

| Goods received |

As you have now physically received the stock, the stock level at the warehouse specified on the order is updated. If the item uses the FIFO or Average costing methods, the cost price of the item is also updated. |

| Invoice recorded and posted |

The stock nominal account is increased by the value of stock bought. If the price on the item on the invoice is different to the price of the item on the order, then difference is posted to the PO Differences nominal account. |

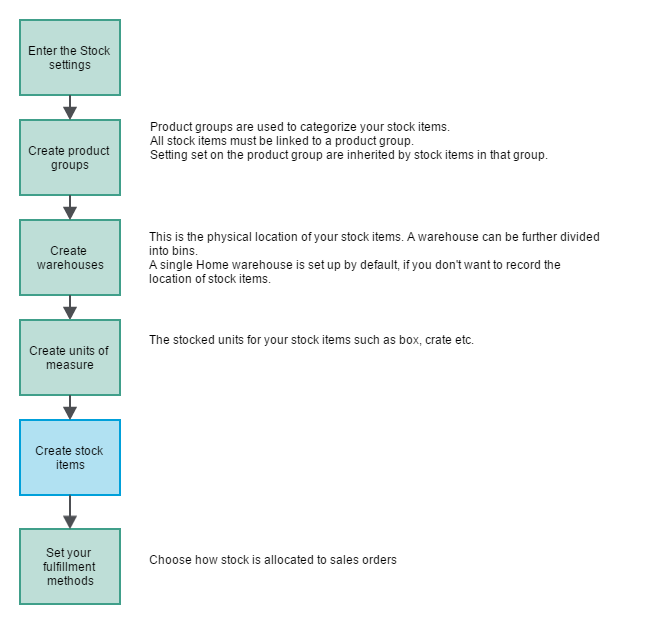

Product groups

In Sage 200, similar stock items are grouped together in Product Groups. Some settings are set at the product group level and are applied to stock items in the group.

All the stock items in a product group must have of the same type and use the same costing method.

It is important that you carefully consider how to group your products into Product Groups as this is hard to change once you've started using Sage 200.

Product types

You can have three different types of stock item:

- Stock - for physical items you want to count.

- Service/Labour - This is for non physical items that you can't count such as time, labour and service.

- Miscellaneous - This is for physical items of stock that you don't want to count. These would usually be small items such as screws or bolts.

Costing methods

The costing method tells Sage 200 how to calculate the cost price of your stock items. This cost price is used to work out:

- The value of the stock you currently hold.

- The value of transactions that are posted to stock asset nominal account when the stock is bought.

- The profit made on a sales order when stock is sold.

Choose from the following costing methods:

-

FIFO (First In First Out)

This uses the oldest price paid for the stock item until all the stock bought at that price is used. Then the next cost price is used. The price is updated when a purchase order for item is recorded as received or a return is recorded as despatched.

-

Standard

This uses the cost price stated on the stock record. The price is only updated when the cost price is changed on the stock item.

Standard costing is useful if you want to value your stock consistently, disregarding the variability of the price you actually pay for it. It can also be used if you need to account for additional costs associated with an item. For example, stock items that are bought in and have some type of processing done to them before they are sold.

-

Average

This uses the average price paid for the item currently in stock. This is calculated from the total price paid for the items in stock divided by the number of goods in stock.

It's calculated in the following way:

((Current Total Qty in Stock * Current Average Buying Price) + (Quantity Brought In * Price Brought In) )/ (Current Total Qty in Stock + Quantity Brought In).

The price is updated when a purchase order for item is recorded as received or a return is recorded as despatched. It is not updated when goods are sold.

Warehouses

If required, you can record the physical location of your stock items in Warehouses and Bins. A Warehouse generally represents a single physical location (such as single building) and a Bin is a shelf, aisle or other location within a warehouse. You can keep records of your actual stock levels, prepare stocktake sheets and print picking lists for your sales orders, all by separate location.

It is important that you carefully consider how you set up your warehouses as this if difficult to change later.

If you don't need to keep track of your stock items in different locations, then you can just add all your stock to the default HOME warehouse, which has already been set up for you.

Decisions to make about your stock items

Before you start entering details about your stock items, you need to consider how you want Sage 200 to manage and control this.

-

Do you use want to maintain details of your non- stock items, such as services or labour that you also charge for?

If so, create product groups for these items.

- Which costing methods do you want to use?

- How do you want group your stock items?

-

Do you want to keep track of your stock levels in more than one physical location?

If so set up warehouses (locations).

-

Do you want to be able to add international shipping costs (landed costs) for items on your purchase orders?

If so turn on and set up landed costs.

-

Do you want to record the stocked unit for your stock items, such as Each, Box, Carton etc?

If so, set up units of measure.

- Are you using purchase order processing to manage your stock purchases? If you're not using POP, you can allocate and issue stock using the stock options.

-

Do you order some goods from your suppliers to directly fulfil you sales orders?